Nigerian fintech startup Kuda — a digital-only retail financial institution — has raised $1.6 million in pre-seed funding.

The Lagos and London-based firm just lately launched the beta model of its on-line cell finance platform. Kuda additionally acquired its banking license from the Nigerian Central Financial institution, giving it a distinction in comparison with different fintech startups.

Kuda is the first digital-only Bank in Nigeria with a standalone license. We’re not a cell pockets or just a cell app piggybacking on an present bank,

Kuda bank founder Babs Ogundeyi advised TechCrunch.

We’ve constructed our personal full-stack banking software program from scratch. We are able to additionally take deposits and join on to the change

Ogundeyi mentioned, referring to the Nigeria’s Central Change

A consultant for the Central Financial institution of Nigeria (talking on background) confirmed Kuda’s banking license and standing, telling TechCrunch, “So far as I’m conscious there is no such thing as a different digital financial institution in Nigeria that has a micro-finance license.”

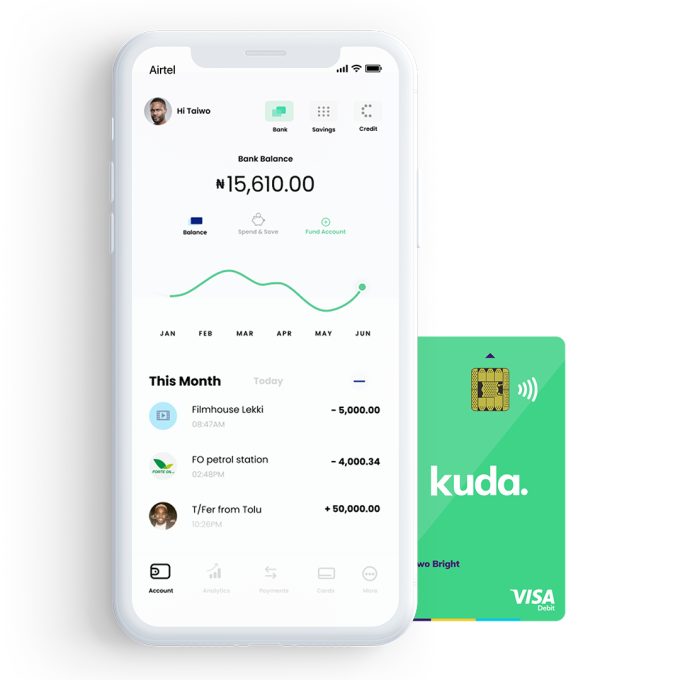

Kuda gives checking accounts with no monthly-fees, a free debit card, and plans to supply shopper financial savings and P2P funds choices on its platform in coming months.

You may open a checking account inside 5 minutes, do all of the KYC within the app, and also you get issued a brand new checking account quantity

Ogundeyi — a repeat founder who exited classifieds website Motortradertrader.ng and labored in a finance advisory function to the Nigerian authorities — co-founded Kuda in 2018 with former Stanbic Financial institution software program developer Musty Mustapha.

The 2 satisfied investor Haresh Aswani to steer the $1.6 million pre-seed funding, together with Ragnar Meitern and different angel traders. Aswani confirmed his funding to TechCrunch and that he’ll take a place on Kuda’s board.

Kuda plans to make use of its seed funds to go from beta to stay launch in Nigeria by fourth-quarter 2019. The startup may even construct out the tech of its banking platform, together with help for its developer workforce positioned in Lagos and Cape City, in accordance with Ogundeyi.

Kuda additionally intends to develop within the close to future. “It’s Nigeria for proper now, however the plan is construct a Pan-African digital-only financial institution,” he mentioned.

As of 2014, Nigeria has held the twin distinction as Africa’s largest economic system and most populous nation (with 190 million folks).

To scale there, and add some bodily infrastructure to its on-line mannequin, Kuda has correspondent relationships with three of Nigeria’s largest monetary establishments: GTBank, Entry Financial institution and Zenith Financial institution.

He clarified the banks are companions and never traders. Kuda prospects can use these banks’ branches and ATMs to place cash into financial institution accounts or withdraw funds with no price.

Although we don’t personal a single department, we even have the most important department community within the nation

Ogundeyi Mentioned

Kuda’s plans to generate revenues focus largely round leveraging its financial institution balances. “We plan to match completely different legal responsibility lessons to the completely different asset lessons that we create. That’s how we earn cash, that’s how we get effectivity by way of earnings,” Ogundeyi mentioned.

In Nigeria, Kuda enters a doubtlessly revenue-rich market, however its one which already hosts a crowded fintech discipline — because the nation turns into floor zero for funds startups and tech funding in Africa.

In each uncooked and per capita numbers, Nigeria has been slower to transform to digital funds than main African nations, similar to Kenya, in accordance with joint McKinsey Firm and Gates Basis evaluation carried out a number of years in the past. The identical examine estimated there might be almost $1.three billion in income up for grabs if Nigeria may attain the identical digital-payments penetration as Kenya.

A variety of startups — established and new — are going after that prize within the West African nation — a number of with a technique to scale in Nigeria first earlier than increasing outward on the continent and globally.

San Francisco-based, no-fee cost enterprise Chipper Money entered Nigeria this month.