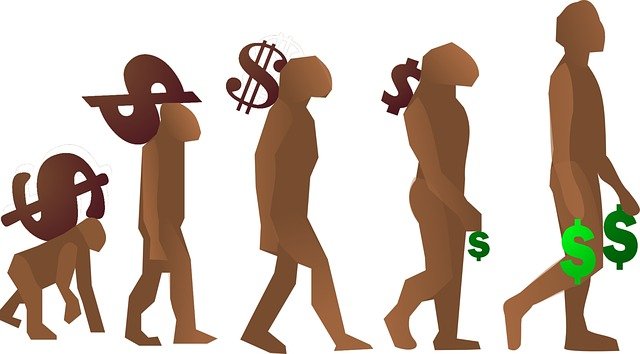

Financial stability is a state of mind that comes from having the resources to meet financial obligations and maintain living standards.

It has many benefits. It helps you sleep better at night and it reduces your stress levels. You can also have peace of mind knowing that you will be able to handle any unexpected expenses or emergencies that come up in the future.

How to Build a Foundation of Financial Stability

Financial stability is an important factor in life. It provides a sense of security and peace of mind. But it’s not easy to build a foundation of financial stability. Many factors affect your financial stability and it takes time to learn how to manage them all.

The following 6 principles will help you build a foundation of stability:

• You need to know where you stand financially

• You need to have a plan

• You need to be able to assess risk

• You should avoid debt

• Don’t make emotional decisions about money

• Take care of your mental health

Different types of Financial Stability

Financial stability is a term that is often used to describe the security of an individual’s finances. This can mean different things for different people, but it usually means that the person has enough money to live comfortably without worrying about paying their bills.

There are two types of stability: short-term and long-term.

Short-term financial stability

This is when someone has enough money to cover their expenses for a few months or years.

Long-term financial stability

This is when someone has enough money to cover their expenses for the rest of their life, or at least until they retire.

Debt prevents you from building your foundation for Financial Stability

Debt is a common problem for many people across the world. It can be very difficult to get out of debt and build a foundation for finances, but it’s not impossible.

There are ways that you can get rid of your debt and start building up your financial stability. One way is to create a plan that will help you eliminate debt from your life forever. This plan should include the following steps:

• Create a budget and track your spending habits

• Find out where you’re spending money on unnecessary things

• Cut down on expenses by reducing or canceling subscriptions, such as Netflix or Spotify, or by eating at home more often

• Consider selling items that have depreciated, such as old electronics or clothes that no

How can you eliminate debt?

Debt is a burden and can prevent you from building your foundation for financial stability. The first step to getting out of debt is to set up a debt-elimination plan that will help you get rid of your debt over time.

There are many ways to eliminate debt, such as the snowball method and the avalanche method. These methods vary in their approach, but they both have one thing in common;

They encourage paying off high-interest loans first and then working on lower-interest loans until those are paid off too.

The snowball method works by paying off the smallest balances first and then adding any extra money you have towards the larger balances until they’re all eliminated. The avalanche method starts with the largest balance, pays it off completely, and then works

Conclusion

It is important to have a good financial foundation for your personal and professional life. It will help you in all areas of your life, including your personal and professional life. Financial stability starts with having a strong financial foundation, which will give you the confidence to take risks and be more successful in other areas of your life.